Why Is GSTR-2 Suspended? Everything You Need to Know, Get Practical GST Course in Delhi, 110003, by SLA Consultants India, New Delhi

Mar 22nd, 2025 at 13:14 Learning New Delhi 66 views Reference: 285Location: New Delhi

Price: Contact us Negotiable

GSTR-2, a key component of the Goods and Services Tax (GST) system, was designed for businesses to file details of their purchases and input tax credit (ITC) claims. However, the government suspended GSTR-2 in 2017, leaving many taxpayers with questions regarding the reasons for its suspension and its implications.

Reason for Suspension:

The suspension of GSTR-2 was primarily due to issues related to the complexity and practicality of its filing. When GST was introduced, GSTR-2 was intended to be a self-assessment return that would help reconcile input tax credit with the purchases made by a business. However, the process proved to be cumbersome and prone to errors. The reconciliation process, where the recipient of goods or services matched their purchases with the supplier's returns, created delays and compliance issues. These operational challenges were exacerbated by the technological infrastructure not being fully ready to handle such complex reconciliations.

Furthermore, the government realized that many small businesses lacked the capacity to manage this complexity. Thus, GSTR-2 was suspended until the necessary technological advancements and better systems were in place to manage such filings more efficiently.

Implications of Suspension:

With the suspension of GSTR-2, the GST filing process became somewhat simpler for businesses, as they no longer had to worry about the time-consuming reconciliation process for input tax credit. This suspension helped reduce the burden on businesses, especially small and medium enterprises (SMEs), which were struggling to adapt to the new tax regime.

However, the suspension of GSTR-2 does not mean that input tax credits are no longer applicable. The government has since introduced other mechanisms to track input credits, such as the GSTR-2A and GSTR-3B. GSTR-2A automatically populates the details of the taxpayer's purchases based on the returns filed by the supplier, making it easier to claim input tax credit.

Future of GSTR-2:

As of now, there is no clear indication that GSTR-2 will be reintroduced in the same format. The government may decide to implement a more simplified and automated system, incorporating the lessons learned from the original GSTR-2 framework.

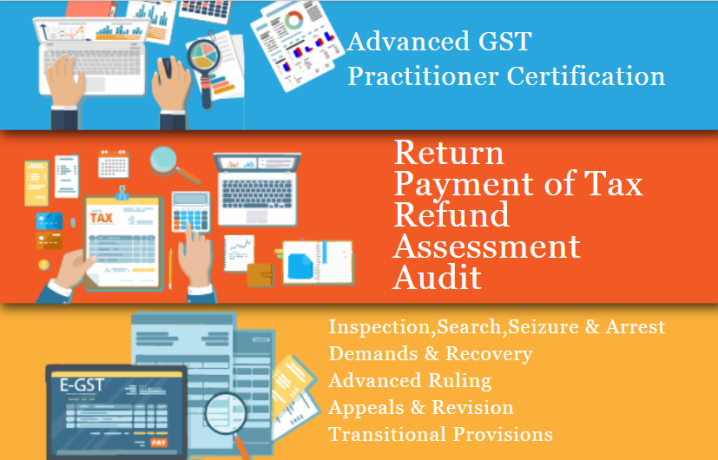

Get Practical GST Course in Delhi:

For those looking to better understand GST and its processes, a practical GST Course in Delhi is an excellent option. SLA Consultants India offers specialized training that covers all aspects of GST compliance, including GSTR-1, GSTR-3B, and more. Their expert instructors provide in-depth knowledge and practical skills necessary for GST-related work. With centers in New Delhi (110003), they help businesses and individuals stay updated with the latest tax norms, ensuring compliance and efficient management of GST.

SLA Consultants Why Is GSTR-2 Suspended? Everything You Need to Know, Get Practical GST Course in Delhi, 110003, by SLA Consultants India, New Delhi Details with "New Year Offer 2025" are available at the link below:

https://www.slaconsultantsindia.com/certification-course-gst-training-institute.aspx

https://slaconsultantsdelhi.in/gst-course-training-institute/

GST Training Courses

Module 1 - GST- Goods and Services Tax- By Chartered Accountant- (Indirect Tax)

Module 2 - Income Tax/TDS - By Chartered Accountant (Direct Tax)

Module 4 - Banking and Finance Instruments - By Chartered Accountant

Module 5 - Customs / Import and Export Procedures - By Chartered Accountant

Contact Us:

SLA Consultants India

82-83, 3rd Floor, Vijay Block,

Above Titan Eye Shop,

Metro Pillar No.52,

Laxmi Nagar, New Delhi - 110092

Call +91- 8700575874

E-Mail: hr@slaconsultantsindia.com

Website: https://www.slaconsultantsindia.com/