Understanding GST Notices Related to ITC Discrepancies, Get Practical GST Course in Delhi, 110085, by SLA Consultants India, New Delhi

Apr 5th, 2025 at 14:51 Learning New Delhi 66 views Reference: 307Location: New Delhi

Price: Contact us Negotiable

Understanding GST Notices Related to ITC Discrepancies - Practical GST Course in Delhi by SLA Consultants India

In India, the Goods and Services Tax (GST) is a crucial tax regime that affects businesses across various sectors. However, businesses often face challenges when discrepancies arise concerning the Input Tax Credit (ITC). The Input Tax Credit allows businesses to claim a deduction for the tax paid on purchases and expenses related to business activities, ultimately reducing their overall tax liability.

Common Causes of ITC Discrepancies: ITC discrepancies usually occur when there are mismatches between the purchase details recorded by a business and those reported by its suppliers. Some of the common reasons for such discrepancies include:

-

Inaccurate Filing by Suppliers: If a supplier does not file their GST returns correctly, the buyer may not be able to claim the credit.

-

Mismatch in GSTR-2A: GSTR-2A is a dynamic statement that reflects the purchases made by a taxpayer, showing the details of the Input Tax Credit available. If the GSTR-2A does not reflect the correct purchases, businesses may face ITC mismatch issues.

-

Ineligible Credit: ITC can be disallowed if it pertains to ineligible goods and services or if proper documentation is not maintained.

GST Notices Related to ITC Discrepancies: When discrepancies in ITC are detected by the GST authorities, businesses may receive a notice. The authorities may issue these notices under Section 73 or 74 of the GST Act, depending on whether the discrepancy is believed to be a result of a genuine mistake (Section 73) or fraud (Section 74).

The notices could involve:

-

Demand for Payment: The tax authorities may demand the payment of taxes due along with penalties if discrepancies are found.

-

Show Cause Notice (SCN): Businesses may be asked to explain or provide documents clarifying the discrepancies before any action is taken.

How to Respond to GST Notices:

-

Review the Mismatch: The first step is to thoroughly check your records and reconcile the data in GSTR-2A with your purchase records.

-

Check Supplier's Returns: Ensure that your suppliers have filed their GST returns correctly and that they have reported the transaction.

-

Submit a Response: If you believe the discrepancy is an error, provide a detailed response along with the required documents to the GST authorities.

-

Consult Experts: For complex issues, it’s advisable to consult GST experts or attend a practical GST course to enhance understanding.

Understanding GST Notices Related to ITC Discrepancies, Get Practical GST Course in Delhi, 110085, by SLA Consultants India, New Delhi

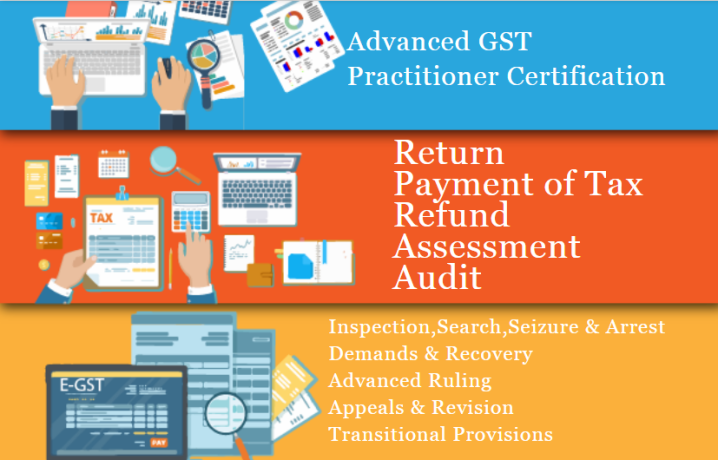

Practical GST Course in Delhi - SLA Consultants India: SLA Consultants India in New Delhi offers a Practical GST Course in Delhi designed to help professionals and business owners better understand and resolve issues like ITC discrepancies. This course covers various aspects of GST, including filing returns, understanding ITC, reconciling GSTR-1, GSTR-2A, and GSTR-3B, and responding to notices from the GST department.

Located in Delhi (110085), SLA Consultants India provides in-depth training with real-life case studies and practical examples. Participants will gain valuable insights into dealing with GST notices and compliance challenges, equipping them to navigate the complexities of GST with confidence.

Conclusion: ITC discrepancies can lead to penalties and interest, but by staying informed and seeking proper training, businesses can manage their GST compliance effectively. The Practical GST Course at SLA Consultants India is a comprehensive way for individuals to gain hands-on knowledge and expertise to handle such issues.

SLA Consultants Understanding GST Notices Related to ITC Discrepancies, Get Practical GST Course in Delhi, 110085, by SLA Consultants India, New Delhi Details with "New Year Offer 2025" are available at the link below:

https://www.slaconsultantsindia.com/certification-course-gst-training-institute.aspx

https://slaconsultantsdelhi.in/gst-course-training-institute/

GST Training Courses

Module 5 - Customs / Import and Export Procedures - By Chartered Accountant

Contact Us:

SLA Consultants India

82-83, 3rd Floor, Vijay Block,

Above Titan Eye Shop,

Metro Pillar No.52,

Laxmi Nagar, New Delhi - 110092

Call +91- 8700575874

E-Mail: hr@slaconsultantsindia.com

Website: https://www.slaconsultantsindia.com/